Introduction

A great idea alone won’t get your startup funded—investors need to be convinced that your business is worth their money. Whether you're pitching to angel investors, venture capitalists, or crowdfunding backers, a strong pitch can mean the difference between securing funding or missing out.Con

This guide walks you through how to craft the perfect pitch, structure your presentation, and handle investor questions with confidence.

1. Understand What Investors Want

Investors aren’t just funding ideas—they’re funding scalable, profitable businesses. They look for:

✅ Strong Market Opportunity – Is there a large, growing market for your solution?

✅ Validated Problem & Solution – Are you solving a real, painful problem?

✅ Scalable Business Model – Can your startup grow without massive cost increases?

✅ Competitive Advantage – What makes you different from competitors?

✅ Traction & Metrics – Have you proven demand with users, revenue, or partnerships?

✅ Strong Founding Team – Do you have the expertise to execute?

✅ Clear Financials & ROI Potential – How will investors get a return on their investment?

💡 Tip: Research the investor before pitching. Do they specialize in your industry or stage? Customizing your pitch increases your chances of success.

2. Crafting a Winning Pitch Deck

Your pitch deck is the core of your presentation. It should be clear, concise (10-15 slides max), and visually appealing.

Must-Have Slides in Your Pitch Deck

1️⃣ Introduction: One-liner about your startup’s mission.

2️⃣ Problem Statement: What problem are you solving? Who experiences this problem?

3️⃣ Solution: How does your product/service solve the problem better than alternatives?

4️⃣ Market Opportunity: Data-driven insights on market size and demand.

5️⃣ Business Model: How do you make money? (e.g., subscriptions, marketplace fees, SaaS).

6️⃣ Traction & Milestones: User growth, revenue, partnerships, product development.

7️⃣ Go-To-Market Strategy: How will you acquire and retain customers?

8️⃣ Competition & Differentiation: Who are your competitors, and what makes you better?

9️⃣ Financials & Projections: Revenue, costs, unit economics, and investment needed.

🔟 Team: Highlight key members and their expertise.

💡 Tip: Investors skim decks quickly. Use data, visuals, and concise messaging—no information overload.

3. Mastering Your Verbal Pitch

Your presentation skills matter just as much as your deck. Delivering your pitch with confidence, clarity, and enthusiasm can win over investors even if your numbers aren’t perfect yet.

How to Deliver a Powerful Pitch:

✅ Start with a hook – Capture attention with a compelling fact, story, or statistic.

✅ Be concise & structured – Avoid rambling; keep it to 7-10 minutes max.

✅ Use storytelling – Investors remember narratives better than facts alone.

✅ Anticipate questions – Prepare for common objections investors may have.

✅ Show passion & expertise – Investors back founders they believe in.

✅ Practice, practice, practice – Rehearse in front of advisors, mentors, or investors.

💡 Tip: Avoid using too many technical terms—keep it simple and investor-friendly.

4. Handling Investor Q&A With Confidence

After your pitch, investors will ask questions to evaluate risk and clarify details. How you answer is just as important as the pitch itself.

Common Investor Questions & How to Answer

🚀 What makes your product unique? – Focus on your competitive edge and moat.

🚀 How will you acquire customers profitably? – Explain your go-to-market strategy and CAC vs. LTV.

🚀 How much capital do you need and why? – Be specific and data-backed with how you’ll use the funds.

🚀 What’s your biggest risk, and how do you mitigate it? – Show that you’ve thought ahead and have contingency plans.

🚀 What’s your exit strategy? – Investors want to know how they’ll make returns (IPO, acquisition, etc.).

💡 Tip: If you don’t know the answer, be honest. Say, “I’ll follow up with more data,” rather than making something up.

5. Mistakes to Avoid When Pitching

🚨 Too much fluff, not enough data – Investors want metrics, not just vision.

🚨 Unrealistic financial projections – Be ambitious but grounded in reality.

🚨 Ignoring competitors – Every startup has competition; acknowledge them and differentiate.

🚨 Talking too much – Get to the point and keep your answers short and impactful.

🚨 Weak storytelling – If your pitch is forgettable, it won’t get funded.

💡 Tip: Record yourself pitching and analyze areas for improvement before meeting investors.

6. Where to Pitch Your Startup

Top Startup Pitch Events & Competitions

✅ TechCrunch Disrupt – Premier global startup competition.

✅ Web Summit Startup Pitches – Massive investor networking opportunities.

✅ Y Combinator & Techstars Demo Days – Exclusive access to top investors.

✅ Local Angel & VC Pitch Nights – Join local startup networks and accelerators.

✅ Online Platforms (AngelList, SeedInvest, Republic) – Raise money digitally.

💡 Tip: The more you pitch, the better you get—apply to multiple competitions to refine your approach.

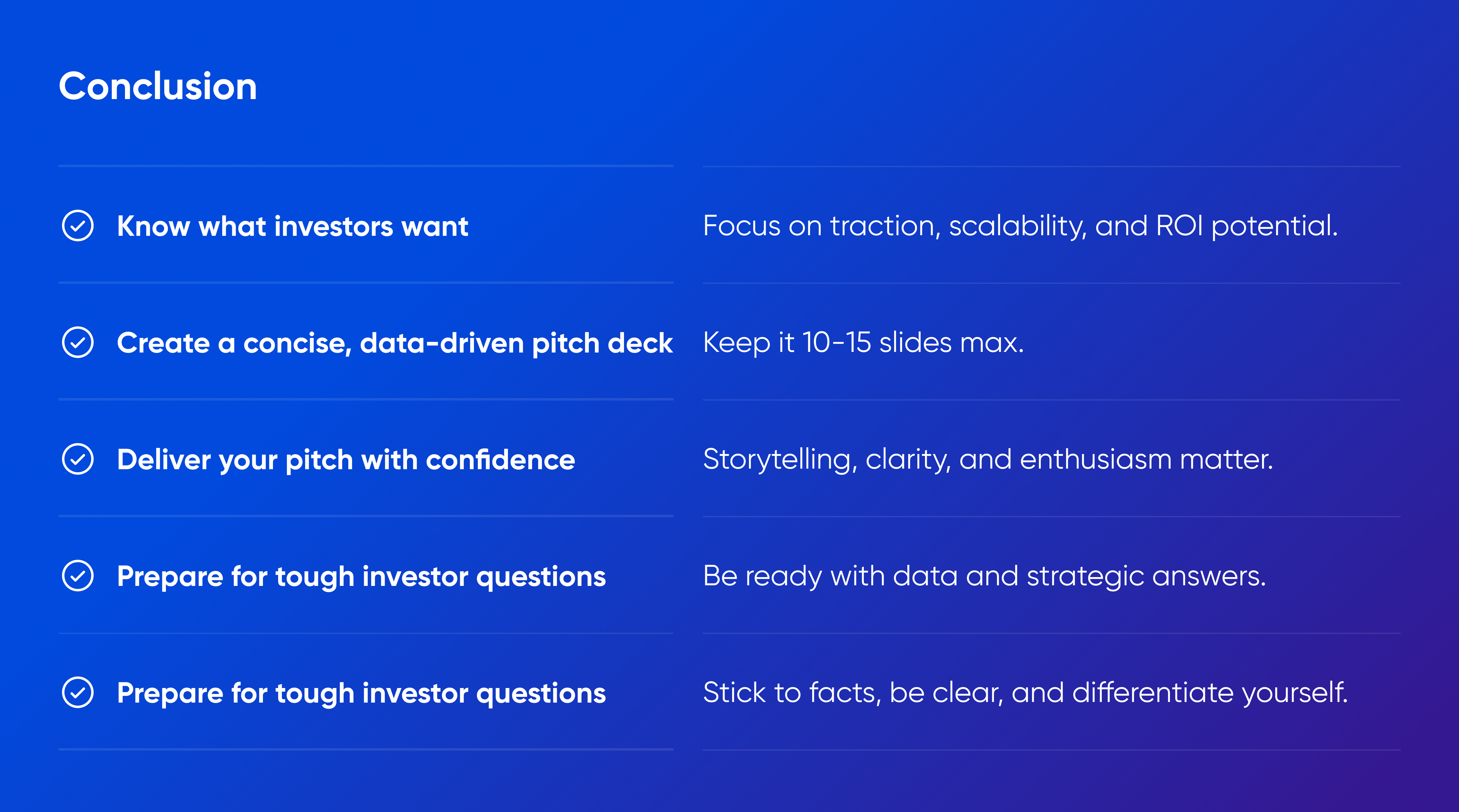

Conclusion: Perfect Your Pitch and Secure Funding

A well-crafted pitch deck, compelling delivery, and strong investor Q&A significantly improve your funding chances.

📩 Need help refining your pitch? Movadex specializes in crafting investor-ready pitch decks and strategies.

💡 Book a free consultation today and get your startup investor-ready!